Standard Bank

Balancing Reliability and Experience: Standard Bank’s Data-Driven Approach to Business Service Resilience

CHALLENGES

- Limited visibility into real customer journeys beyond system uptime metrics

- Hidden frictions in digital registration and login processes impacting conversion

- Disconnect between technical reliability and perceived customer experience

- Inability to identify and prioritize issues based on actual user impact

- Lack of end-to-end, data-driven insight into process variations and bottlenecks

OUTCOMES

- Clear, end-to-end visibility into real digital customer journeys

- Significant reduction (98%) in a critical digital service error

- ~15% improvement in overall service outcomes through insight-to-action monitoring

- Improved prioritization of fixes based on customer impact, not just technical severity

- Stronger collaboration between IT, process excellence, and customer experience teams

- Shift from uptime-focused metrics to customer outcome-driven decision-making

SOLUTION

- Process Mining & Analysis

- Digital Customer Journey Monitoring

- Integration with Observability & Analytics Platforms

- Insight-to-Action Alerts & Threshold Monitoring

- Data-Driven Decision Intelligence for Service Management

Meet our customer hero

Standard Bank is a 163-year-old African financial services leader, headquartered in Johannesburg, South Africa. With operations across 21 countries, it is the largest bank by assets in Africa. Standard Bank provides comprehensive and integrated solutions to its clients, driving inclusive growth and sustainable development across the continent.

The bank has long been recognized for technological reliability and a client-first strategy, and in recent years has accelerated its digital transformation agenda to strengthen customer experience and operational efficiency.

Standard Bank serves 4.5 million digital clients and this number is growing 7% annually, while the number of digital transactions is growing by 12% year-on-year.

Challenge

While system uptime and performance metrics remained strong, the bank identified hidden frictions in its digital client journeys, especially in processes like user registration and login. These pain points were not fully visible through traditional IT or infrastructure monitoring, yet they directly impacted customer satisfaction and conversion rates.

Key challenges included:

- Long or inconsistent processing times across channels.

- A gap between technical reliability metrics and perceived service quality.

- Lack of end-to-end visibility into real user behavior and bottlenecks.

The strategic question Standard Bank asked itself was: How can the bank move beyond system reliability to achieve a holistic understanding of client experience, and translate that into measurable improvements in service outcomes?

Approach

Step 1 – From models to real-world insight

Standard Bank already had a comprehensive documentation of process models for key customer journeys, managed in ARIS. These models served as the blueprint for how they envisioned client interaction in a structured, user-friendly format. While these models are important for setting standards, they did not reflect actual client behavior in production environments.

To bridge this gap, the Process Excellence team integrated ARIS Process Mining with observability tools like Splunk and Adobe Analytics, enabling a live view of system events and customer interactions.

Transaction data has since been sampled daily between 7 and 8 am and analysed and reviewed weekly.

Step 2 – Revealing process frictions

By mining and analyzing event data from the bank’s digital registration and login journeys on its mobile platform, the team can now reconstruct real customer journeys and identify variations from standard processes. The analysis of the registration process revealed significant insights, including:

- Steps where users abandoned registration.

- Error loops or retries that were invisible in traditional dashboards.

- Journey variants correlated with increased completion time.

Automatic “insight to action” notifications were set up to notify process owners of threshold breaches. Monitoring journey patterns allows process owners in the bank to identify issues affecting customer experience, apply changes, and monitor the effects of that change on journey experience in a continual cycle. This provides Standard Bank with an unprecedented level of process observability and quality control.

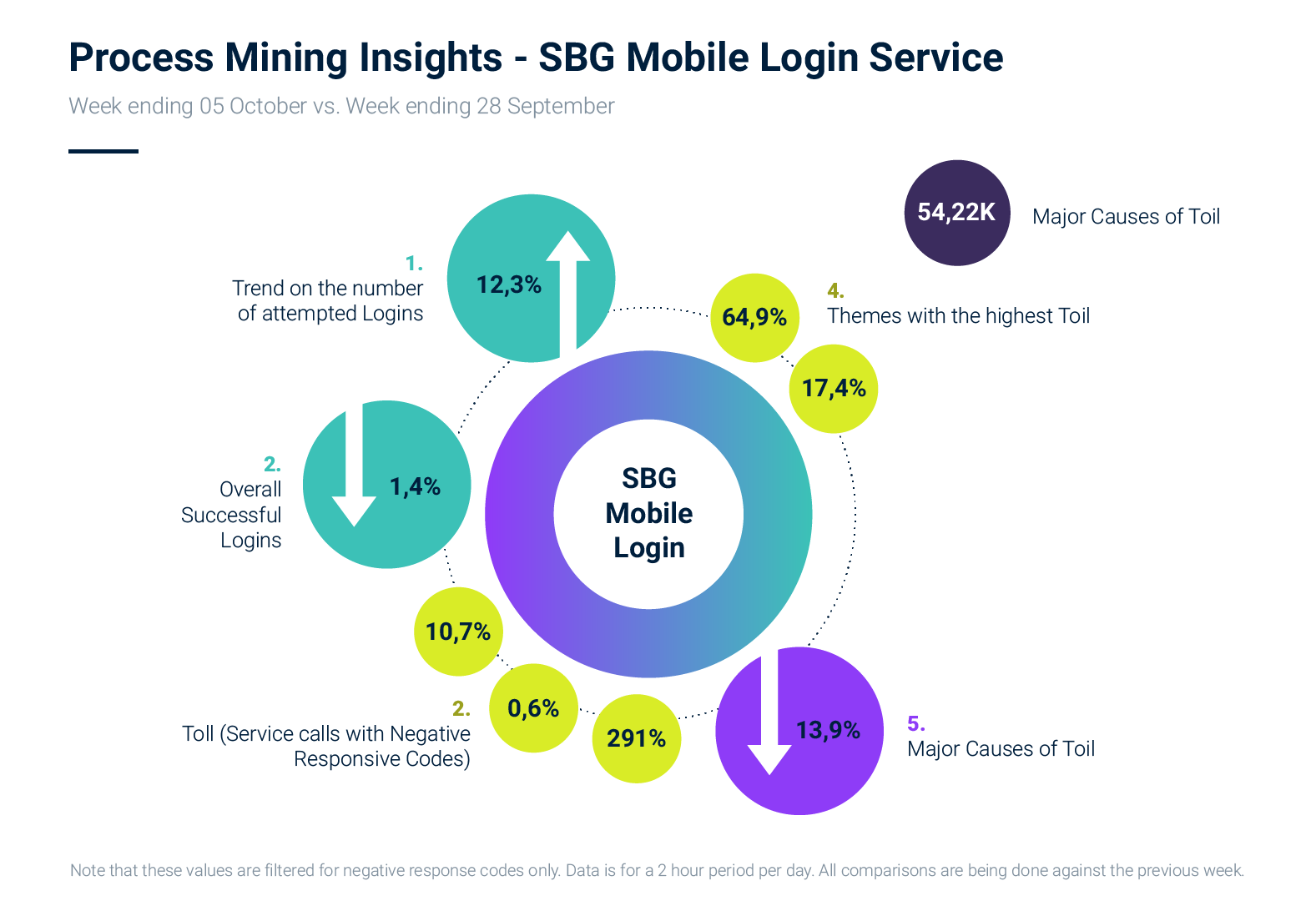

Below is a snapshot of a portion of Standard Bank’s weekly dashboard used by process managers to track the impact of online journey improvements. In this particular week, the percentage of successful logins dropped slightly while overall attempts were up significantly compared to the prior week. The dashboard indicates the trends for several root causes for rework.

Step 3 – Linking reliability and experience

A critical insight was that system reliability alone did not guarantee a seamless customer experience. The team developed new dashboards combining:

- Technical metrics: system uptime, latency, transaction volume.

- Business metrics: journey completion rates, error recovery paths, and user satisfaction indicators.

This allowed Site Reliability Engineering (SRE) teams to prioritize fixes by user impact, not just technical severity.

For example, a minor backend delay was deprioritized since it didn’t affect users, whereas a seemingly small login error received top priority because it significantly disrupted user journeys.

Impact

The approach allowed Standard Bank to improve customer experience by prioritising those issues in the underpinning processes that affected customer journeys the most. The result includes:

- A specific digital service error identified through process mining was reduced by 98%.

- Trend analysis, historical monitoring, combined with “insight-to-action” interventions improved overall service outcomes by ~15%.

- End-to-end customer journey monitoring became a standard operating practice.

While these results positively impacted Standard Bank’s net promotor score (NPS), the bank also achieved secondary but potentially more fundamental effects which support the bank’s commitment to customer excellence moving forward:

- Shifted organizational focus from uptime metrics to client outcome metrics.

- Strengthened collaboration between engineering, customer experience, and business operations teams.

- Embedded data-driven decision intelligence into daily service management.

Go beyond simply “process intelligence” and start running intelligent processes.

It’s time to revolutionize the way you work. Transform your business, optimize operations, and stay in control of your business with ARIS.