See Your Finance Operations Clearly – And Act with Confidence

Traditional ERP reports provide data, but they often miss the context of what’s happening around the numbers. Bottlenecks in approvals, manual rework slowing your close, and workarounds that risk compliance remain hidden.

Your ERP shows what happened. ARIS shows why—and where your close, cash, or compliance is at risk.

With ARIS, you get a clear, actionable blueprint of how your operations truly function, complete with the data, its business implications, and precise guidance on how to fix inefficiencies, reduce risk, and drive faster, more impactful outcomes.

Drive Cash Flow. Reduce Costs. Stay Compliant.

Cash Flow & Working Capital Optimization

- Accelerate cash inflows and strengthen liquidity by streamlining Order-to-Cash, reducing Days Sales Outstanding, and resolving disputes faster.

- Shorten close cycles and free up finance capacity with automation that eliminates manual reconciliations and repetitive adjustments.

- Close the books on time, every time with accurate, audit-ready reconciliations—covering everything from account balances to complex intercompany transactions.

Process Efficiency & Cost Reduction

- Unlock early payment discounts and reduce cycle times with Procure-to-Pay streamlining.

- Minimize policy violations and approval delays in Expense Management.

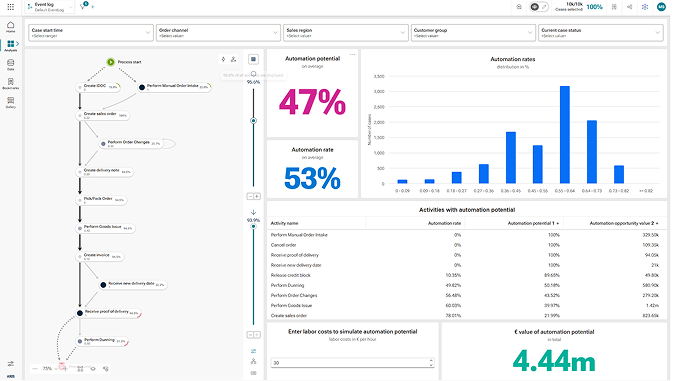

- Pinpoint the highest-value AI-driven automation opportunities to free up team capacity and deliver rapid ROI.

- Benchmark performance and track gains over time for Continuous Improvement.

Data Integrity & Compliance

- Resolve inconsistencies that disrupt performance with AI-driven insights.

- Harmonize processes across units and regions for consistent Shared Services delivery.

- Ensure compliance and audit readiness with automated monitoring and reporting.

– Rosana Polimanti | Organization and process manager, Bancor"Multiple disruptive forces are reshaping the banking landscape in Argentina: Higher interest rates, assertive regulations, and customer demands for customization. We use the ARIS Suite to model a complete business process lifecycle that helps us adapt to these constant changes.”

Want to learn more?

The Path to Agentic AI: Why Financial Institutions Need Process Visibility

Discover how AI-powered process management is redefining operational excellence—helping organizations boost efficiency, reduce risk, and accelerate transformation.

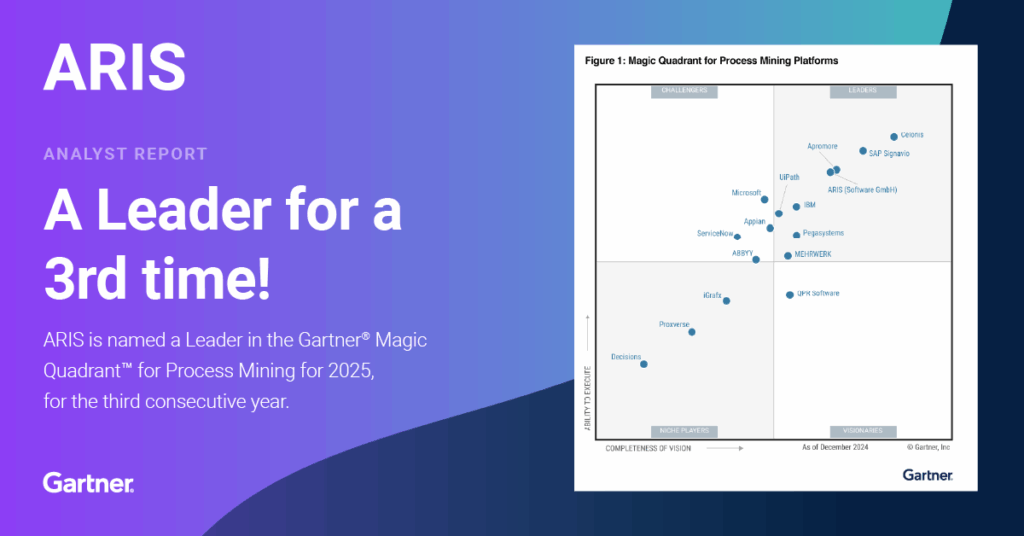

Analyst Report 2025 Gartner® Magic Quadrant™ for Process Mining Platform

For the third consecutive year, ARIS has been positioned as a Leader in the Gartner® Magic Quadrant™ for Process Mining Platforms.